One thing I am currently undertaking and am passionate about for everyone is investing in yourself by up-skilling and adding to your skill set, I see myself as a living breathing document that needs constant updating and improvement, this gives me confidence and ensures I deliver the best service to my clients. Investing in yourself manifests in many forms, your health and well being are just as important as your skill set.

Like many business owners, I usually spend my week juggling that tight rope of work, family and life and then inevitably work weekends to stay on top of everything – sounds like you?

One of the things you can do to free up time is outsource your bookkeeping, don’t spend your weekends buried in invoices and receipts, this is vital family time, when you should taking the kids to footy or netball or visiting that Dinosaur exhibit that you’ve been meaning to see.

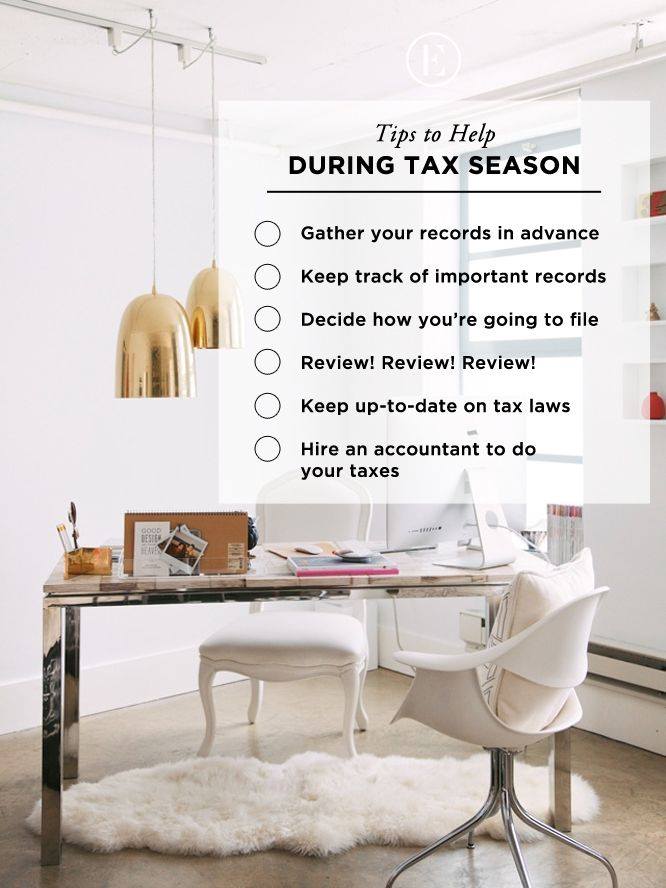

I love this list so wanted to share with you…

1. Invest in your health

Exercise and nutrition may involve some time cost, but without wellbeing, only suboptimal results can ever be achieved. The greatest wealth, as the traditional saying goes, is health.

2. Grow your skill set

Take courses to improve your skills, particularly in the areas you perceive are your weakest suits.

3. Hire help

Hiring help such as a bookkeeper, an administrative staff member or a cleaner may come with a financial cost, but the principle of opportunity cost holds that these may be funds well spent if they free up time for you to focus on more important or productive matters.

4. Choose mentors

One of the greatest shortcuts to success — both in small business and in life — can involve identifying mentors who have already successfully accomplished what you want to achieve, and then resolve to learn from what has worked for them and what has not. Model those who have succeeded, and follow their path. Better still, why not decide to improve upon their path?

5. Read to learn

When engrossed in day-to-day travails, it’s frequently difficult to see the wood for the trees or acknowledge the bigger picture. This can be particularly so during the early growth phases of a small business, where the business owner can be covering a wide range of roles.

Stepping away from the detail of your business to read about new ideas and strategies can be a highly effective blueprint. There are so many wonderful resources written by brilliant business people that it would be a shame if you didn’t set some time aside for them.

6. Make time

In an ideal world we’d all resolve to invest in ourselves, yet many business owners don’t because they don’t have time.

Yet, we all have 24 hours in a day and 7 days in a week, so by definition we all have the time! What we really mean is that we have other priorities.

How do you start investing in yourself?

Firstly, at the start of each day write a list of bullet points of what you want to achieve, and tick them off as you go. This alone should make your day more effective.

Secondly, just for one day, keep a time diary of how you spend each hour of the day. Take a careful note of the time expended on activities of a low yield, such as checking for new emails or idly perusing social media.

Through efficiency and focus you should be able to make to time to invest in both your business and in your most valuable asset of all: yourself!